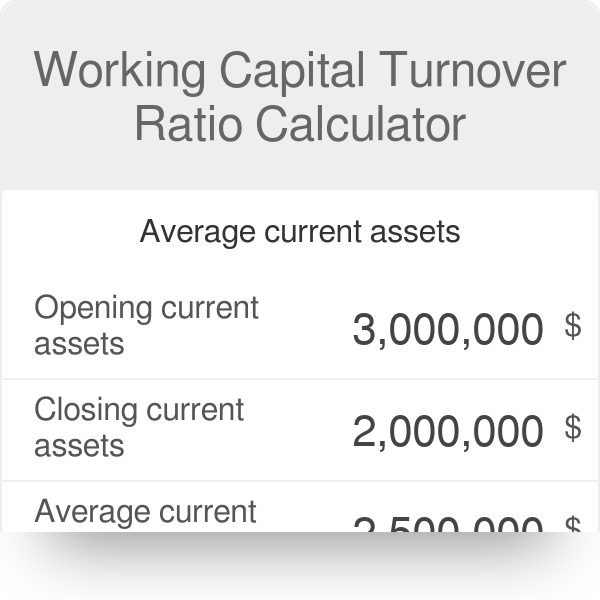

working capital turnover ratio calculator

Use the following working capital turnover ratio formula to calculate the working capital turnover ratio. Company B 2850 -180 -158x.

Working Capital Turnover Ratio Different Examples With Advantages

Working capital Turnover ratio Net Sales Working Capital.

. Before you can calculate your working capital turnover ratio you need to figure out your working capital if you dont know it already. 100000 40000. Generally a higher ratio is better and suggests that the company does not require more funds.

What is the working capital turnover ratio for Year 3. The working capital turnover ratio calculation ignores disgruntled employees or economic downturns both of which can have an impact on a companys financial health. To arrive at the average working capital you can sum.

About Working Capital Turnover. Working Capital Turnover Ratio Calculation and Analysis. Together with ratios such as inventory.

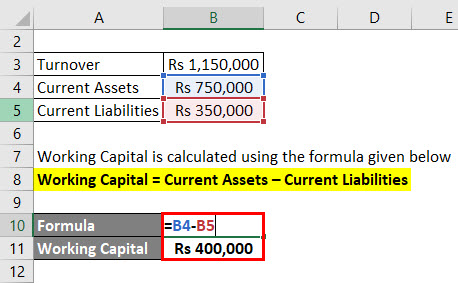

The calculation would be sales of 320000 divided by average working capital of 22000 which equals a working capital turnover ratio of 145 times. Working Capital Current Assets - Current Liabilities. The formula to measure the working capital turnover ratio is as follows.

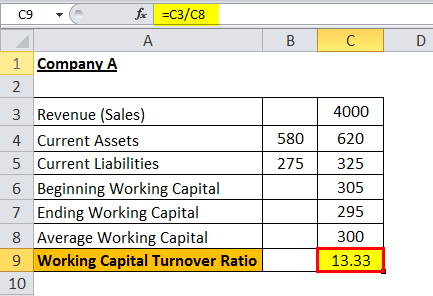

The working capital turnover calculator helps in determining the efficient working of this by the management. Now that we know all the values let us calculate the Working capital turnover ratio for both the companies. If this ratio is around 12 to 18 This is generally said to be a balanced ratio and it is assumed that the company is in a healthy state.

Similarly a lower ratio depicts poor management of short-term funds. The formula to determine the companys working capital turnover ratio is as follows. Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue.

It requires fixed monthly interest. But an extreme higher ratio may also have drawbacks attached to it. Working Capital Turnover Ratio.

Interpreting the Calculator Results If Working Capital Turnover increases over time. The Working Capital Turnover ratio measures the companys Net Sales from the Working Capital generated. High or increasing working capital turnover is generally a good sign as it shows that either the.

Turnover rate employees who left employees at the beginning of given period employees at the end of given period 2 100. The formula for calculating this ratio is by dividing the companys sales by the companys working. The ratio provides investors with a look at how effectively a company is leveraging its working capital to generate sales.

Company A 1800340 20x. Now that you know how to calculate turnover rate lets go through a short example. Now that Jen has the income statement and balance sheet she finds the following lines items and amounts.

Working capital turnover ratio Net Sales Average working capital. We calculate it by dividing revenue by the average working capital. The resulting number is your working capital turnover ratio.

Net sales average working capital working capital turnover ratio 10000000 2000000 50. The working capital turnover ratio is an effective way that companies use to. A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue.

Now working capital Current assets Current liabilities. Venture Debt is a financing structure similar to that of a traditional bank loan. The working capital turnover ratio measures how efficiently a business uses its working capital to produce sales.

In general a high ratio can help your companys operations run more smoothly and limit the need for additional funding. The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as a result. 150000 divided by 75000 2.

Revenue-Based Financing provides company with working capital in exchange for a percentage of future monthly revenue. An increasing Working Capital Turnover is usually a positive sign showing. First lets calculate the average working capital.

Working Capital Turnover Ratio Formula. Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC. A higher ratio indicates greater efficiency.

Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business. Working Capital Turnover 190000 95000 20x. You can monitor the Working Capital Turnover Ratio to make sure you are optimizing use of the working capital.

This means that for every 1 spent on the business it is providing net sales of 7. A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations. What this means is that Company A was more efficient in generating Revenue by utilizing its working.

Average working capital would be the average of 20000 and 24000. Working capital can be calculated by subtracting the current assets from the current liabilities like so. When a companys accounts payable are extremely high the working capital turnover indicator may be deceiving.

How to calculate a working capital turnover ratio. Once you know your working capital amount divide your net sales for the year by your working capital amount for that same year. Example of the Working Capital Turnover Ratio.

This ratio would be indicating that the company is struggling to. If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. The companys working capital is the difference between the current assets and current liabilities of a company.

As clearly evident Walmart has a negative. WC Turnover Ratio Revenue Average Working Capital. This means that XYZ Companys working capital turnover ratio for the calendar year was 2.

WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover ratio. 420000 60000. It signifies how well a company is generating its sales concerning the working capital.

Lets say over the last year 9 people left a company which had an average of 91 employees over that time. From the 20x working capital turnover ratio we can conclude that the business generates 2 in net sales for each dollar of net working. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company.

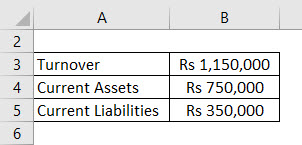

Calculate working capital turnover ratio from the following data. Therefore the working capital ratio for XYZ Limited is 50. The calculation of its working capital turnover ratio is.

The Working Capital Turnover Ratio provides a measure to compare the depletion of working capital to the generation of sales over a specific period of time. Putting the values in the formula of working capital turnover ratio we get. This company has a working capital turnover ratio of 2.

ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. This means that for every one dollar invested in working capital the company generates 2 in sales.

Asset Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Calculator

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation